Lucid ( LCID ) is reassuring investors about growth plans after its stock hit a new low

After Lucid Group’s ( LCID ) share price hit a new all-time low this week, the company’s communications chief is set to set the record straight.

Lucid shares hit new lows as investors wait

Lucid faces new headwinds in the US at a critical time as the electric car maker looks to enter the next phase of growth. It is ramping up production of its first electric SUV, the Gravity, and is set to launch its mid-size platform in late 2026.

Like all automakers, the company is facing new headwinds in the US under the Trump administration, but that’s not stopping Lucid from continuing its mission to “change the world through innovation and efficiency.”

Lucid’s chief communications officer, Nick Twork, assured investors on Thursday that while others are pulling back, the company is still forging ahead.

“We know this has been a challenging time for our long-term holders,” Twork said, adding, “We are focused on execution and transparency.” Twork reaffirmed to investors that Lucid has a “strong liquidity trajectory”, including a $2 billion PIF credit facility and a further $2 billion in refinanced convertible bonds now maturing in 2030/31.

$LCID investors: we know this has been a challenging time for our long-term holders. We focus on execution and transparency. As our CFO Taoufiq said, we have a strong liquidity track, including an undrawn PIF credit facility of $2 billion and have refinanced $2 billion of converted… pic.twitter.com/4gvzFqmpLj

— Nick Twork (@ntwork) December 18, 2025

While other automakers are scaling back plans for electric cars, including the latest Ford, “we’re working through it and moving forward,” Lucid’s communications chief said.

After magnet shortages and other supply chain constraints hampered Gravity production early on, Lucid now expects the electric SUV to make up the majority of production and deliveries in the fourth quarter.

Speaking at Nasdaq’s 53rd annual investor conference last week, Lucid’s interim CEO, Marc Winterhoff, said the company was “on track” to meet its plan to produce 18,000 vehicles this year. That’s on the low end of the original target of 20,000 to 18,000, but Winterhoff said production is ramping up and Lucid now has “weeks where we’re building 1,000 vehicles” in a single week.

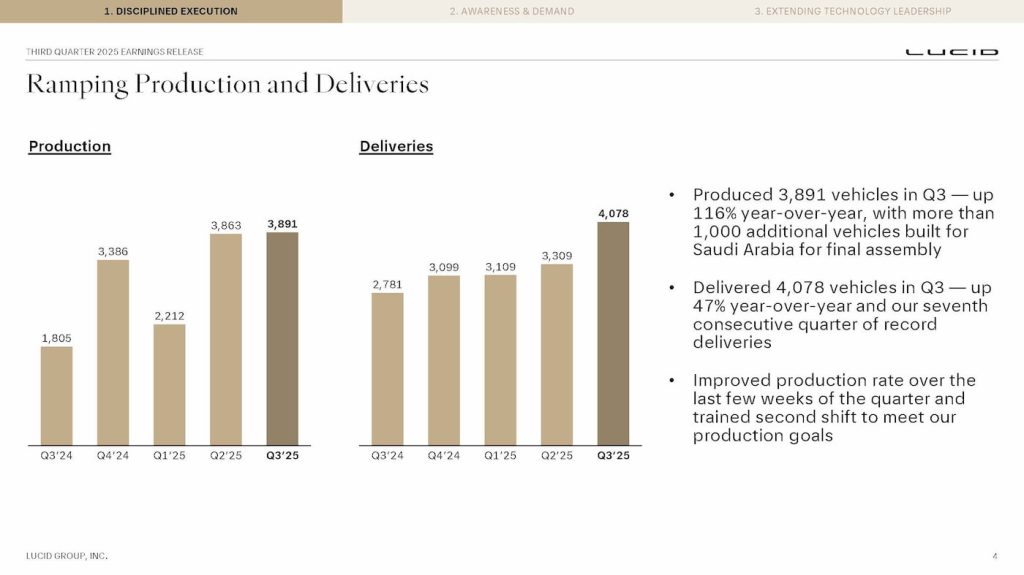

Hitting the 18,000 target will not be easy. During the third quarter, Lucid produced 9,966 EVs, which means it will need to produce more than 8,000 more in the fourth quarter. That’s more than double the 3,891 in the third quarter.

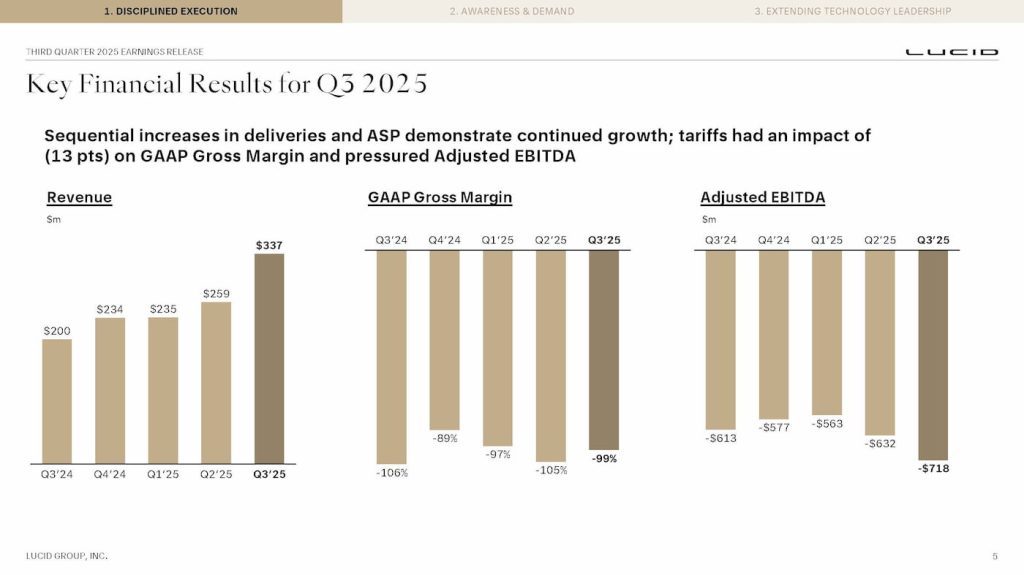

Lucid had about $4.2 billion in liquidity at the end of the third quarter, but after agreeing with PIF to increase its deferred drawdown credit facility (DDTL), the company said total liquidity would be around $5.5 billion.

The capital is enough to fund it in the first half of 2027, Lucid said. Late next year, Lucid will begin production of its mid-size platform, which will underpin at least three new vehicles priced around $50,000.

The first Lucid midsize model will be an electric crossover SUV, followed by a more rugged version inspired by the Gravity X concept. The third is said to be a midsize sedan that will compete with the Tesla Model 3.

During the chat by the fireplace in UBS Global Industrials and Transportation Conference earlier this month, Lucid’s chief financial officer, Taoufiq Boussaid, said mid-size EVs will be positioned at the “heart of the market,” starting around $50,000.

While shares of Rivian ( RIVN ) and Tesla ( TSLA ) have traded up more than 50% and 27%, respectively, since the start of 2025, Lucid’s share price is down more than 60%. Earlier this week, Lucid stock touched an all-time low of $11.09 per share.

Twork said Lucid will share more information about its growth plans during the Capital Markets Day in the first quarter.

FTC: We use automatic affiliate links with income. More.