‘Major turning point’: Plug-in vehicles make up more than a quarter of new cars sold this year

Emerging markets around the world are driving an important shift in the automotive market, with a quarter of new cars sold so far in 2025 being either a battery electric vehicle (BEV) or a plug-in hybrid EV (PHEV).

According to a new report published this week by global energy think tank Ember, which analyzed available monthly data for 60 countries – which cumulatively accounted for more than 97% of global electric vehicle sales in 2024 – new markets are rapidly switching to plug-in vehicles, putting to rest the theory that EV adoption will stall outside of Europe and China.

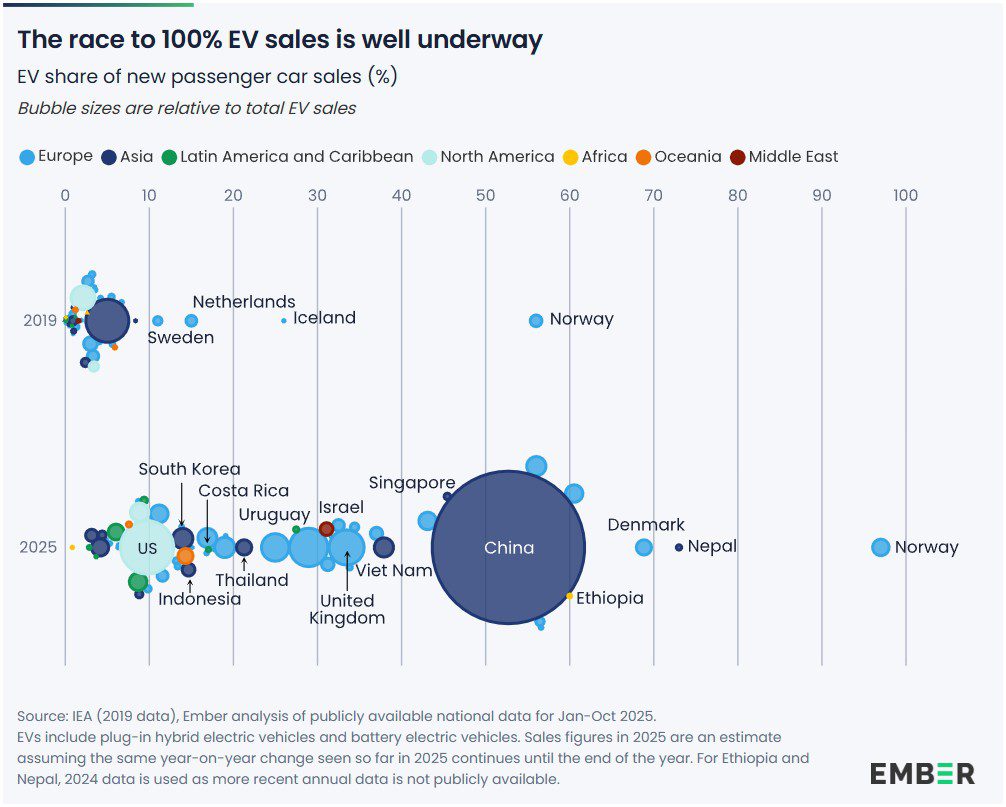

BEVs and PHEVs combined accounted for more than a quarter of global new car sales this year, up from less than 3 percent in 2019, according to Ember’s analysis of national monthly data.

Ember’s analysis focused specifically on the passenger car market, comparing data across countries for the first ten months of the year where possible, although for some countries such as Australia, Canada and South Africa, data was only available for the first nine months of 2025.

The findings from Ember’s analysis reveal an important story of emerging markets that are rapidly taking EV share in advanced economies and legacy automotive markets.

There are now 39 countries where electrified vehicles account for more than 10 percent of new car sales, up from four just a few years ago in 2019.

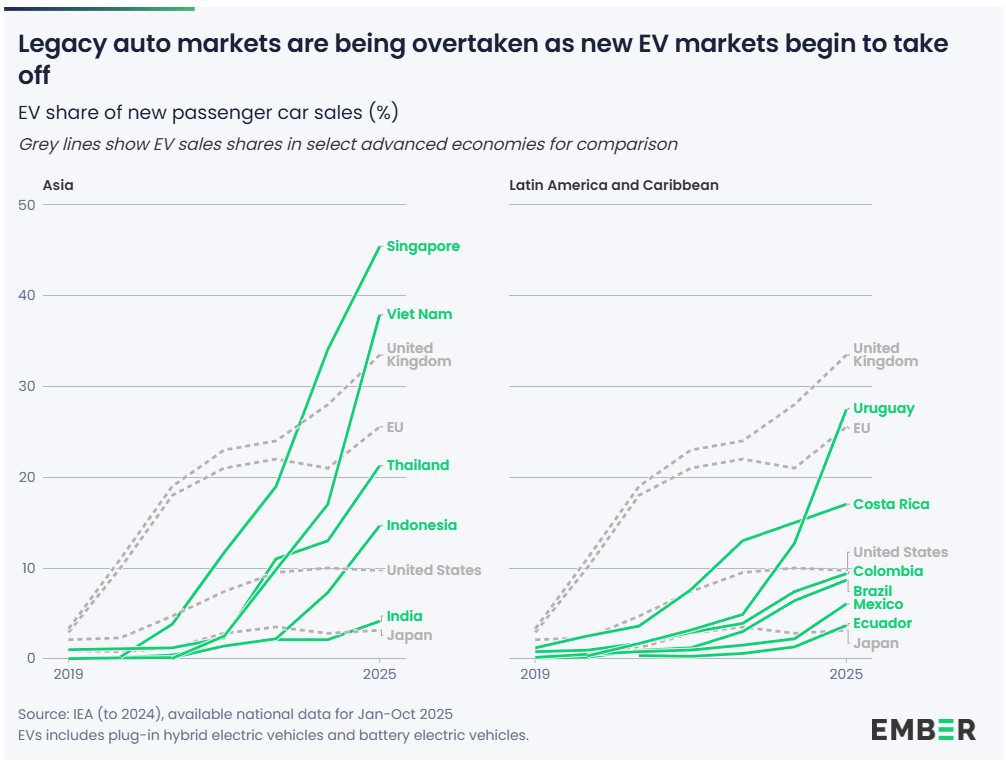

Much of this growth has taken place outside of Europe, with the Association of Southeast Asian Nations (ASEAN) region emerging as a major adopter of EVs this year, accounting for a third of countries that now boast EV sales of over 10 percent.

For example, Singapore and Vietnam have seen EV sales of around 40 percent, overtaking the UK and the European Union, which have EV sales penetration of only 33 percent and 26 percent, respectively.

Vietnam’s story has literally been meteoric, considering that as late as 2021, the country could only boast an EV sales share of less than 0.05 percent.

Similarly, India, Mexico, and Brazil now all have higher EV sales than Japan’s, while Indonesia’s share of EV sales has surpassed that of the United States. Other markets gaining momentum include Uruguay and Türkiye.

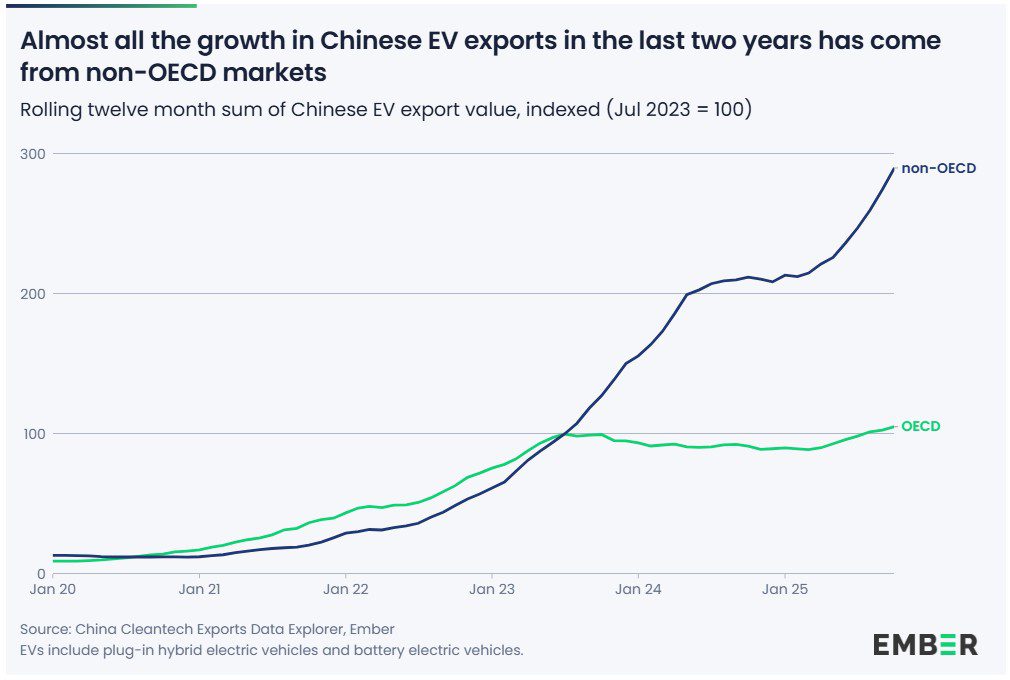

Importantly, Ember’s analysis found that from mid-2023, almost all of the growth in China’s electrified vehicle exports will come from non-OECD markets. Brazil, Mexico, the United Arab Emirates, and Indonesia are among the top ten destinations for China’s EV exports in 2025 thanks to top-down policies designed to promote EV adoption.

“This is a major turning point,” said Euan Graham, electricity and data analyst at Ember. “In 2025, the center of gravity has shifted.

“Developing markets are no longer catching up, but are leading the transition to electric mobility. These countries see the strategic benefits of EVs, from cleaner air to reduced fossil fuel imports.”

“The assumption that EV growth outside of Europe and China will stop is already outdated. The future of the global automotive market will be shaped by emerging markets. Decisions made now about charging infrastructure and timely support will determine how quickly this momentum continues.”

Unsurprisingly, China remains the dominant market in absolute terms, surpassing 50 percent EV share for the first time this year, accounting for nearly two-thirds of global EV sales for the second year in a row.

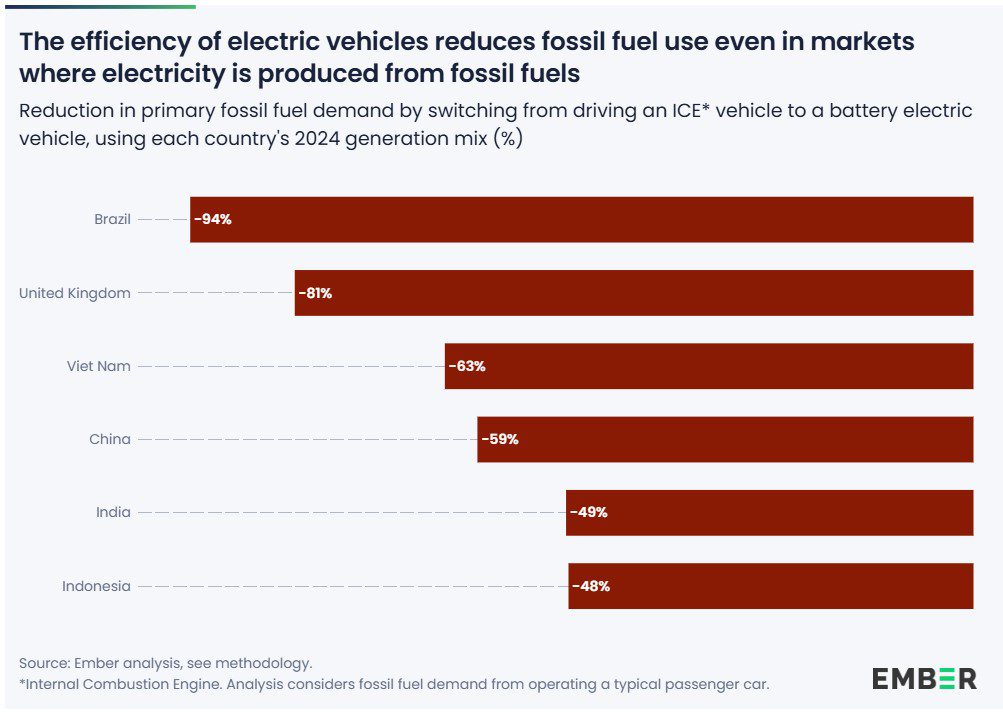

Ember’s analysis also highlighted the impact of electrified vehicles on fossil fuel dependence in countries where EV sales are growing.

The role of EVs on fossil fuel demand and emissions in a given country will depend on the specific electricity mix, but in Brazil, for example, which has one of the cleanest electricity mixes in the world thanks to its large hydroelectric plants, EVs help achieve an estimated 90 percent reduction in fossil fuel demand compared to ICE vehicles.

But even in countries with a less impressive electricity mix, electrified sources still bring benefits. Specifically, as Ember explains, ICE cars waste about 80 percent of their energy in fuel, where EVs use almost 80 percent of the electricity they use, leading to “a large reduction in overall fossil fuel consumption, even though the country’s electricity supply is heavily dependent on fossil fuel generation.”

See also The Driven’s monthly data on electric car sales in Australia by model and brand.

Joshua S. Hill is a journalist from Melbourne who has been writing about climate change, cleantech and electric vehicles for over 15 years. Since 2012, he has been reporting on electric vehicles and clean technologies for Renew Economy and The Driven. His preferred mode of transportation is his feet.